japan corporate tax rate 2017

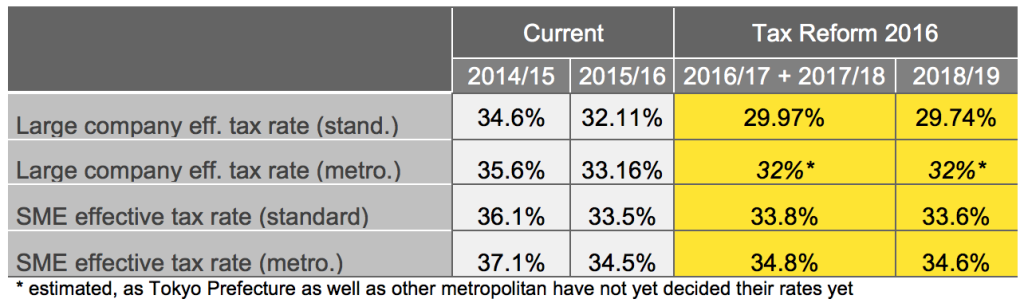

Corporate - Group taxation. At present Japans corporate tax rate is 3211 percent.

Europe Turns On Facebook Google For Digital Tax Revamp European Data News Hub

10 of Taxable Income.

. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it to 3133 percent in. Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. The corporate tax rate in Japan for a branch is the same as for a subsidiary.

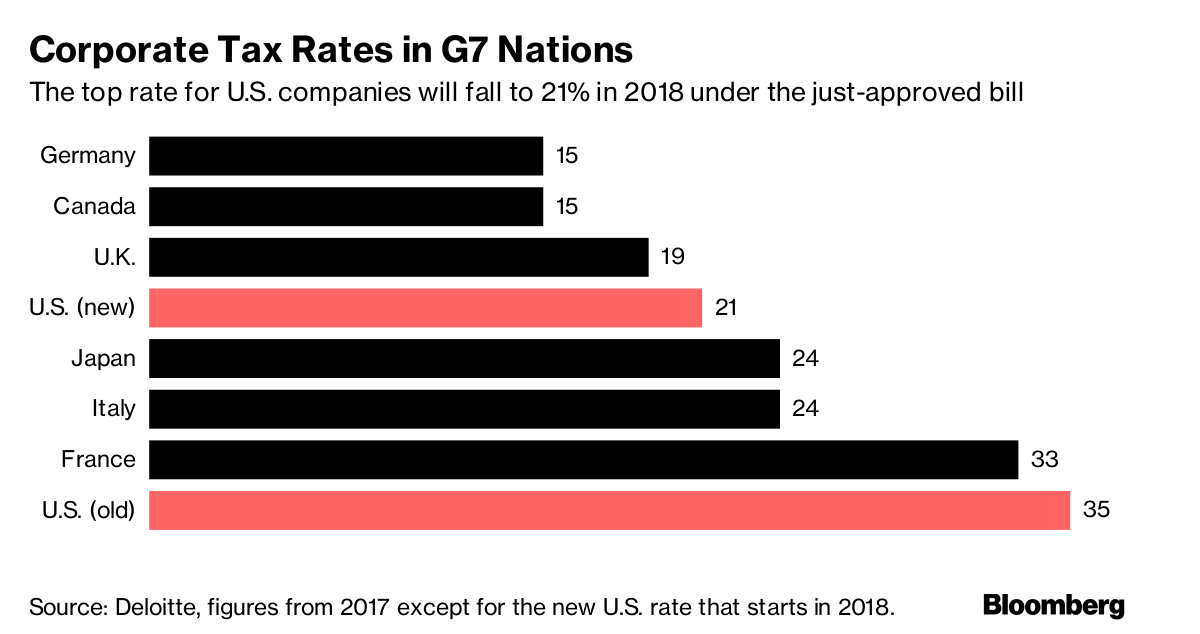

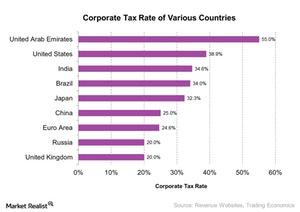

In the world as of 2017to 21 in 2018. Japan Corporate Tax Rate was 3062 in 2022. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Country Tax Profile - assetskpmg. Year Taxable Income Brackets Rates. The United Arab Emirates has the worlds highest corporate tax rate and several Caribbean nations have the lowest.

The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after. Over JPY 8 million. Income from 0 to 1950000.

Total Thousand toe 1998-2017 Japan red Total Thousand toe 2017. A 10 tax credit for the promotion of income growth where a company raises wages by at least 5 from the base year and meets certain other criteria for fiscal years beginning on or after 1. Corporate Tax Rates 2022.

96 67 96 70 Local corporate special tax or special corporate business tax the rate is multiplied by the income base of size-based enterprise tax. Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide. Japan Income Tax Tables in 2017.

Effective Corporate Tax Rates With Alternative Rates of Inflation. Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief. At present Japans corporate tax rate is 3211 percent.

Single Taxable Income Tax Brackets and Rates 2017. Rate Taxable Income Bracket Tax Owed. Historical Corporate Tax Rates and Brackets 1909 to 2020 Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020.

GIG is a specialist group established to respond to the.

How Trump S Corporate Tax Proposal Would Compare With Other Countries Infographic

Japan S Corporate Tax Rate Expected To Be 30 86 By End Of This Quarter Customs Today Newspaper

Us Tax Plan Takes Aim At Offshore Centres Cayman Compass

Can You Explain Why Individual Taxation Has Risen In Sync With The Fall Of Corporate Taxation Is It Good Quora

High Corporate Taxes Hurt All Americans

Japan Corporate Tax Rate 2022 Take Profit Org

What Could A New System For Taxing Multinationals Look Like The Economist

Corporate Tax Rates Around The World Tax Foundation

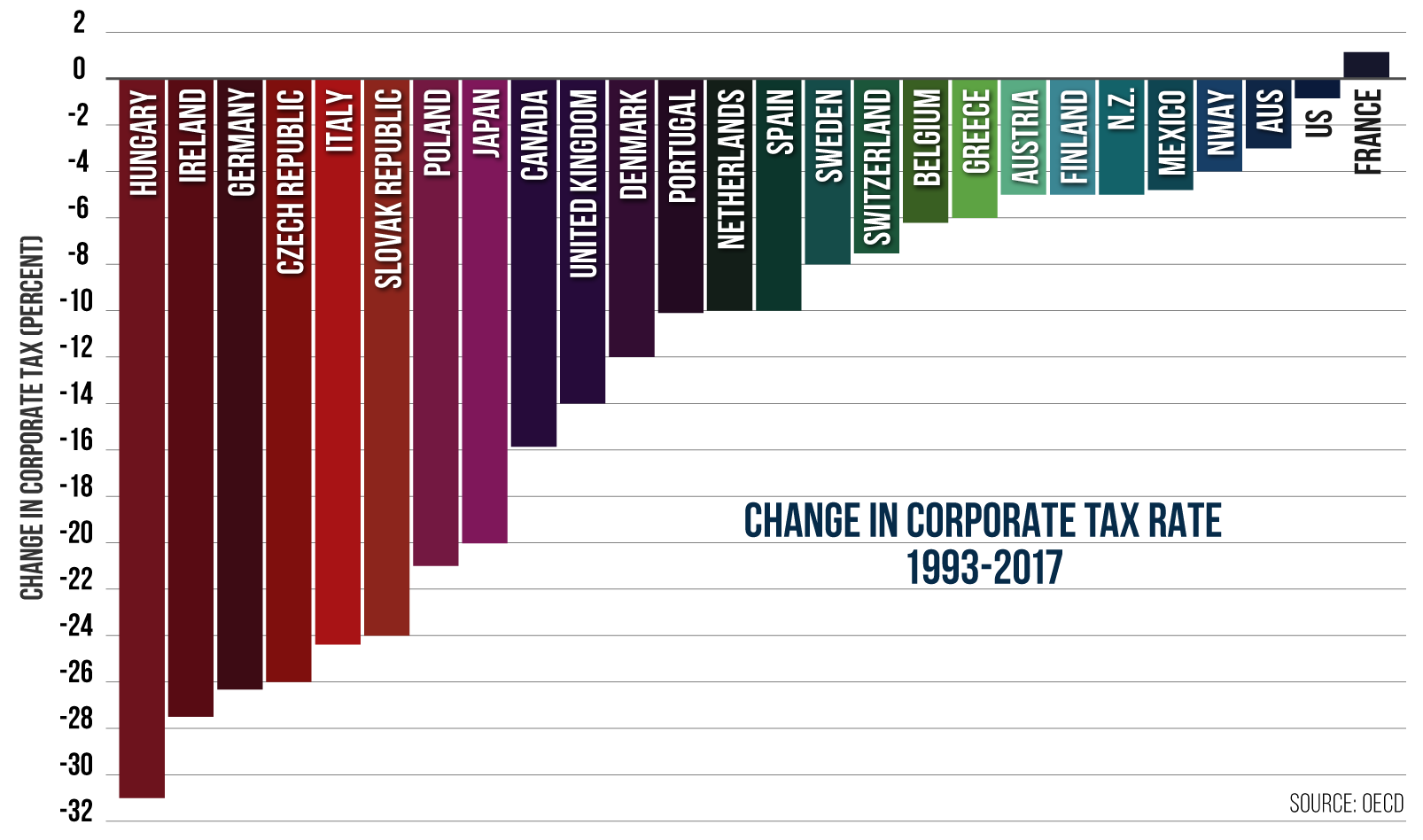

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

What Largest Tax Overhaul In 30 Years Means For Companies Bloomberg

Corporate Tax Rate Pros And Cons Should It Be Raised

Why Buffett Believes Us Businesses Aren T Really Hurting From The Us Corporate Tax

2017 Tax Reform Outline Eu Japan

Charles Schwab Market Commentary Global Impact Of A Blue Wave Election Outcome

Corporate Tax Laws And Regulations Report 2022 Japan

High Corporate Income Tax Less Pay For Workers Gary D Halbert S Between The Lines

Is Us Highest Taxed Country As Trump Claims

Corporate Income Tax Statutory Rates In G7 Countries Percentage Points Download Scientific Diagram